Indonesia`s #1 Digital Identity and Digital Signature

Powering Fintech Growth with Trusted Identity at Scale

Million Verified User

Company Verified

● PRIvy Feature

The Core Pillars of Secure Digital Lending

From identity verification to contract execution, Privy powers every critical step in your lending workflow.

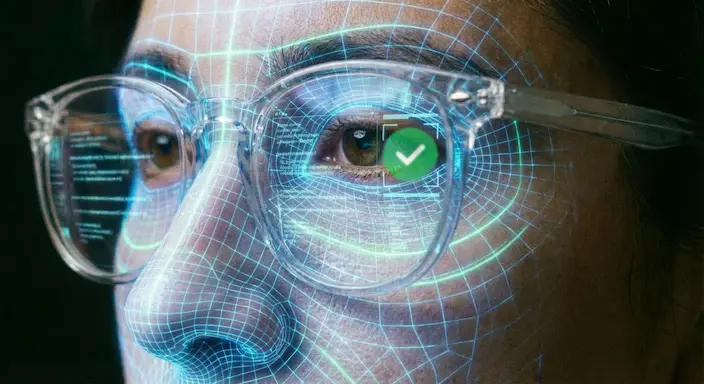

Digital Identity Verification & Fraud Detection

Access to Pre-Verified Digital Identity Pool

Legally Binding Digital Signature

Powering Every Step of

Fintech Journey

Privy powers critical identity, security, and compliance flows across the entire digital lending and fintech customer journey.

Account Opening & Online Identity Verification

Fraud & AML Monitoring

Customer Consent & Digital Agreements

Access Control & Login Authentication