Indonesia`s #1 Digital Identity and Digital Signature

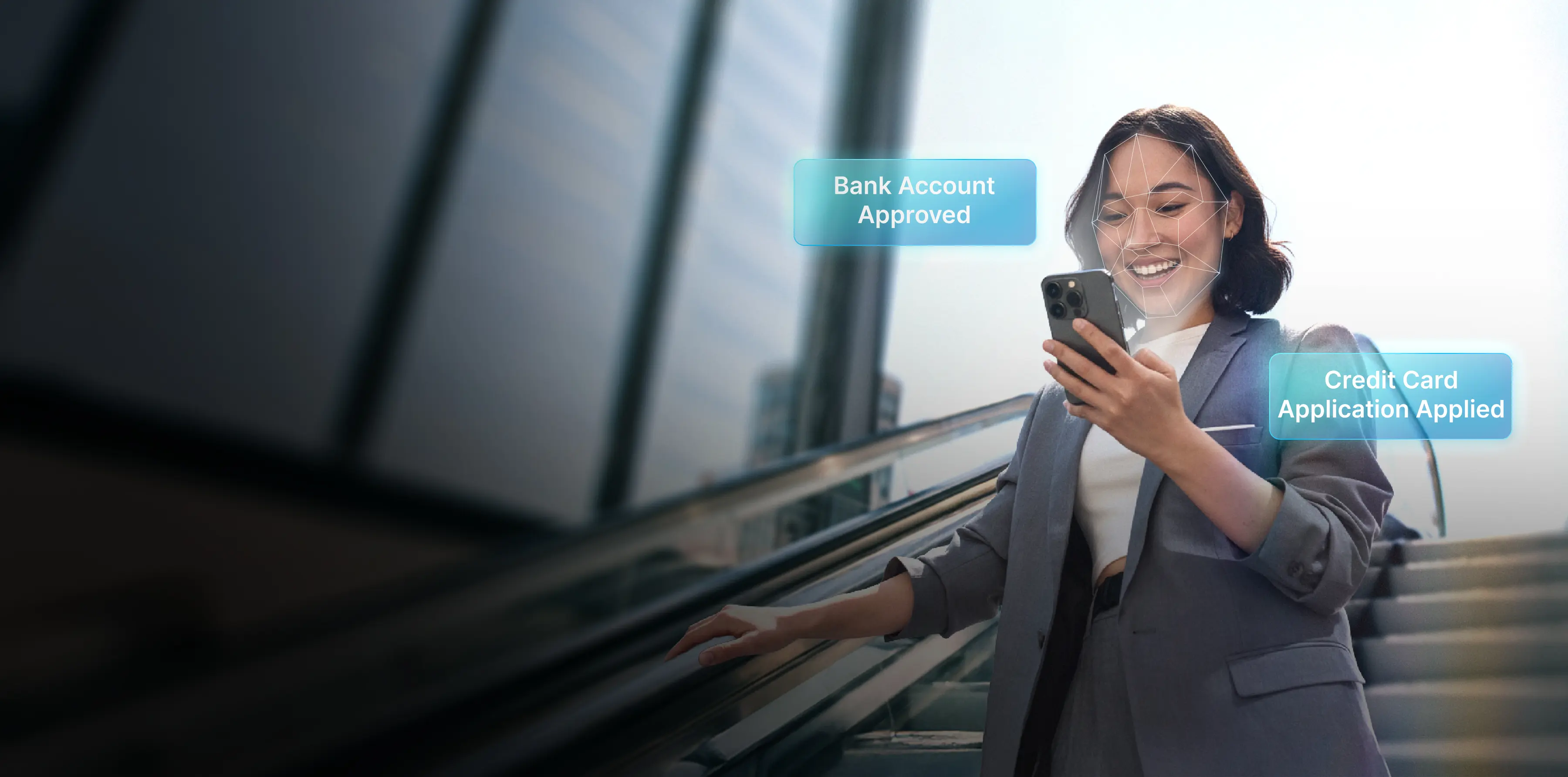

Trusted Infrastructure for Modern Banking Experiences

Million Verified User

Company Verified

Powering End-to-End

Modern Banking Workflows.

From account creation to lending and card issuance, Privy secures every step with legal, digital-first infrastructure.

Customer Account Opening

Credit Card Application

Loan Origination & e-Signing

Transaction Authorization