Indonesia`s #1 Digital Identity and Digital Signature

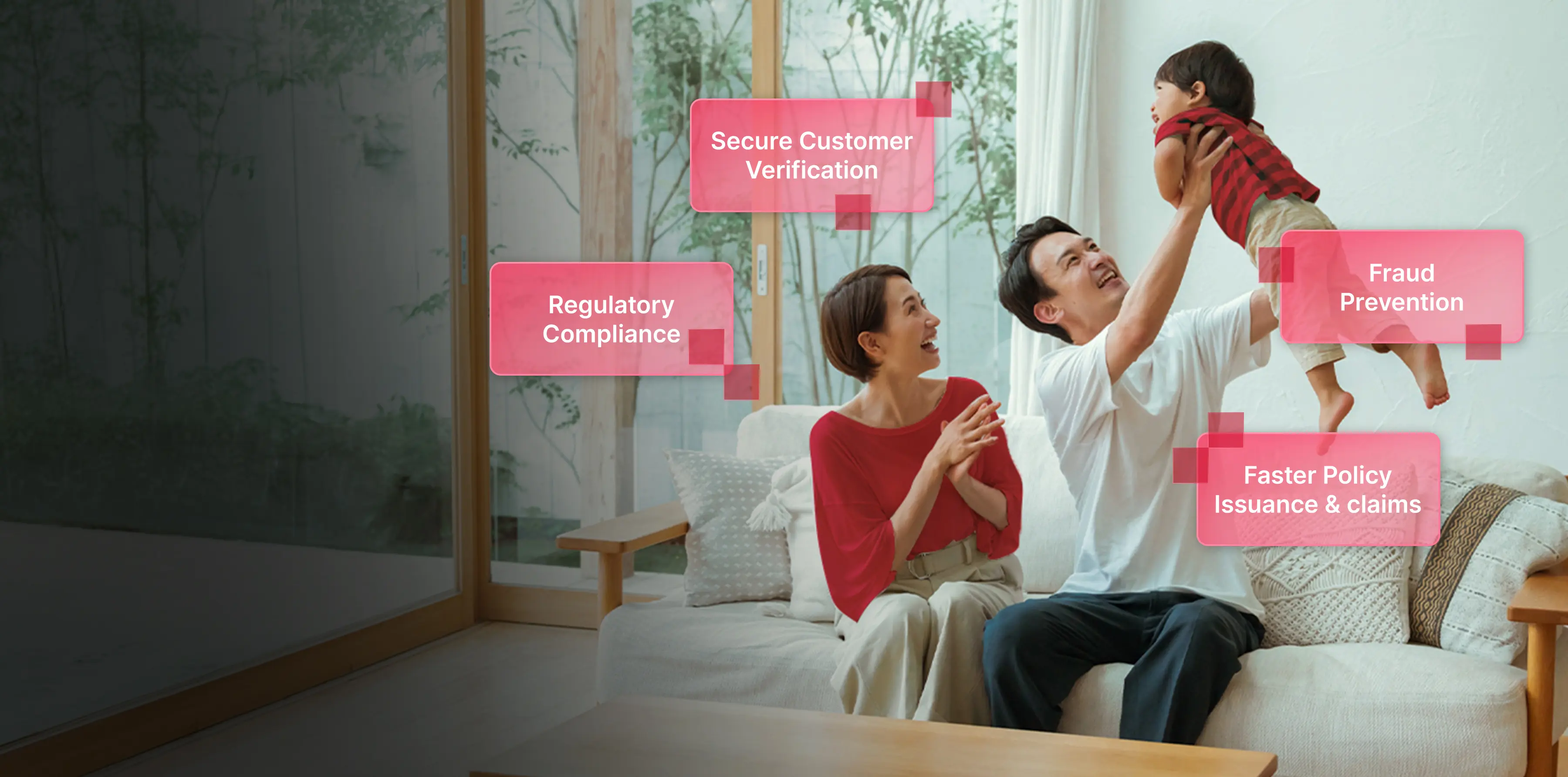

Revolutionizing Insurance with Trusted Digital Identity & Signature

Privy helps insurance providers digitize agent onboarding, policy issuance, and claims workflows, securely and seamlessly. With certified e-signatures and trusted digital identity infrastructure, you're always audit-ready and customer-first.

Million Verified User

Company Verified

Digitizing the Insurance Lifecycle—

from Agent to Policyholde

Privy accelerates digital insurance transformation while keeping every step compliant and secure.

Agent Onboarding & Registration

Instantly verify agent identities and credentials digitally.

Digital Policy Delivery & Signing

Enable instant policy execution with certified e-signatures.

Claims Management

Collect signed declarations and supporting documents without delays.

Customer Consent & Regulatory Forms

Enable remote or in-person signing of important disclosures, declarations, and data use consents.